INVEST IN CURRENT VEHICLE OR BUY NEW

What to do?

There are so many deals going on right now for new vehicles it’s pretty tempting to go ahead and make the plunge into buying a new vehicle.

The cash for clunkers offer seems to have reinvented itself in our area. Trying to convince those of us driving older vehicles to get them off the road and put the new ones on it. Getting some cash in your pocket in return for them removing what seems to be a headache now may seem like a win/win situation.

Buying New

Committing yourself to nearly a decade of payments for a new vehicle could be an option you are willing to make. There can be an uncomfortable amount of stress tied to either of these options. Getting some professional guidance along your journey might take some of the weight off of your shoulders. There are a lot of things to consider when you are making these decisions. The new car smell of the interior, the shiny new paint job. It’s almost intoxicating.

The pros and cons are heavy weights when it comes to making the plunge into an investment like that. If you consider that the average lease or finance option to buy a new vehicle is about six or seven years. That’s a lot of payments and a lot of money. We want you to feel confident about making these decisions. Our goal is to help our customers get the absolute most out of their investments. Be it a new vehicle or investing your current one.

We can evaluate your current vehicle and make recommendations that will help you have an honest out look at what options you have as far as maintaining and investing in your current vehicle. Honestly, sometimes it will make the most sense financially to get out of your old Bessie and trade up for your future.

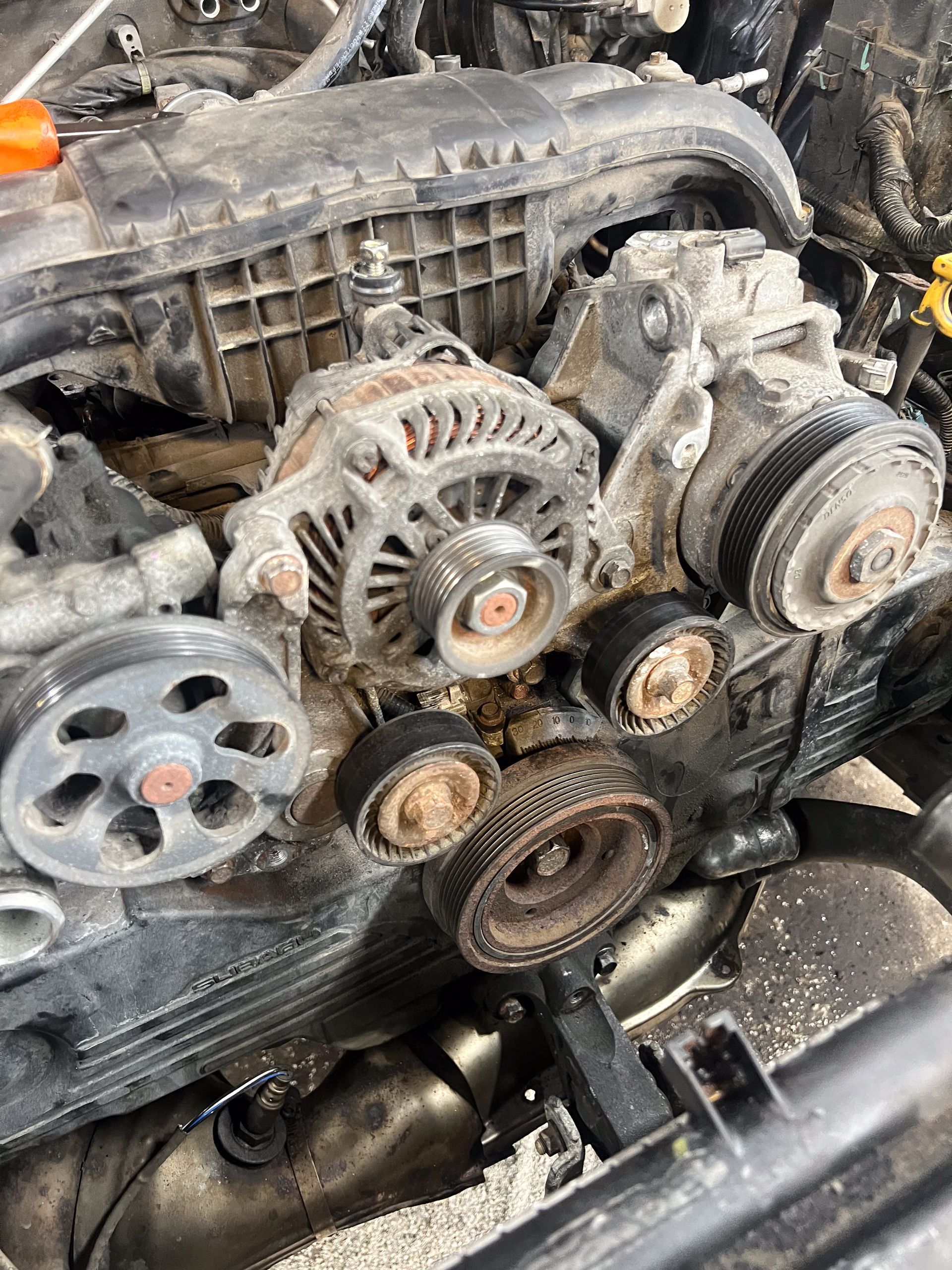

Investing In Your Current Vehicle

In these uncertain times, it might just make more sense to keep your vehicle and put some cash into it now, get the most out of it and consider a newer vehicle at a later time. The average age of vehicles on the road today increases every year because vehicle manufacturers are building quality vehicles that, if serviced properly will last easily past 200k miles.

Our team of technicians are here to help you make those decisions and provide you with the best possible evaluation of your vehicle so that you can be certain that you are making the right choice for your situation. Here are some helpful tips when considering buying new versus used vehicles.

Read Reviews on Vehicles You Are Considering

Should you sell privately or trade it

Kelley Blue Book valuable information on what your vehicle is worth - Read more

What to look for when considering a new vehicle

- Take into consideration what are you using this vehicle for?

- This new vehicle will require service to keep it running optimally.

- Are services such as fluid services, brake linings, direct injection service,

- and cabin and engine air filters included in a new vehicle warranty?

- Are these uses not available with your current vehicle?

How to finance your vehicle repairs

What financing terms are best for you

Many of the major banks offer check ready loan processing. This allows you to be approved for a set budget to go car shopping with. Check with your banking institution to see if they offer loans of this nature. In the past we’ve had customers have success using: PNC, CHASE and Picatinny Federal Credit Union.

Your Automotive Magic Team

Shawn Gilfillan is the dedicated owner of Automotive Magic in Kenvil, NJ. With over two decades of experience, Shawn has led his team in providing expert auto repair and service since 2003.

In 2022, Magic Lube & Rubber was born in Lake Hopatcong, NJ. Committed to fostering strong community ties and supporting team development, Shawn prioritizes customer satisfaction above all. As a proud family man and long-time resident of Roxbury, NJ, Shawn brings a blend of professionalism and warmth to his business.

Trust Shawn and his team for all your automotive needs with confidence and assurance.

Professional Auto Services

cost-effectively provided.

Services

List of Services

-

Car A/C & Heat RepairCar A/C & Heat Repair

-

Brake Repair & ServiceBrake Repair & Service

-

Diagnostics & InspectionsDiagnostics & Inspections

-

Fleet ServiceFleet Service

-

Maintenance & Tune-UpsMaintenance & Tune-Ups

-

Oil & Lube ChangesOil & Lube Changes

-

Tire Service & AlignmentsTire Service & Alignments

-

Transmission ServiceTransmission Service

List of Services

-

Car A/C & Heat RepairCar A/C & Heat Repair

-

Brake Repair & ServiceBrake Repair & Service

-

Diagnostics & InspectionsDiagnostics & Inspections

-

Fleet ServiceFleet Service

-

Maintenance & Tune-UpsMaintenance & Tune-Ups

-

Oil & Lube ChangesOil & Lube Changes

-

Tire Service & AlignmentsTire Service & Alignments

-

Transmission ServiceTransmission Service

Services

List of Services

-

Car A/C & Heat RepairCar A/C & Heat Repair

-

Brake Repair & ServiceBrake Repair & Service

-

Diagnostics & InspectionsDiagnostics & Inspections

-

Fleet ServiceFleet Service

-

Maintenance & Tune-UpsMaintenance & Tune-Ups

-

Oil & Lube ChangesOil & Lube Changes

-

Tire Service & AlignmentsTire Service & Alignments

-

Transmission ServiceTransmission Service

List of Services

-

Car A/C & Heat RepairCar A/C & Heat Repair

-

Brake Repair & ServiceBrake Repair & Service

-

Diagnostics & InspectionsDiagnostics & Inspections

-

Fleet ServiceFleet Service

-

Maintenance & Tune-UpsMaintenance & Tune-Ups

-

Oil & Lube ChangesOil & Lube Changes

-

Tire Service & AlignmentsTire Service & Alignments

-

Transmission ServiceTransmission Service

© 2024 Automotive Magic. All Rights Reserved | Website managed by Shopgenie